Microcredit or Microfinance is the process of granting small loans to poor people, primarily to women, who have no collateral and are marginalised. These women tend to use their income to benefit their households and children. The process is accomplished through a microfinance institution that:

- recruits and trains responsible, appropriate borrowers, each of whom establishes her small business

- helps them form groups that are accountable for each other's loans

- distributes funds for loans

- meets with groups of borrowers to collect loan repayments and to guide their endeavours

Examples of enterprises established include, buying a buffalo to sell its milk; starting a kirana store; manufacturing sweets; selling soft drinks; grinding spices; sewing; candle making; collecting fallen hair for wigs and extensions; repairing watches; tea or petty shops; vegetable stands; bicycle repair; carpentry and welding shop or an auto rickshaw.

In groups of five to ten, the women support each other emotionally and financially by guaranteeing the repayment of each of their loans. With as little as INR 4,000 (USD 85), a borrower can start a kirana store. With INR 10,000 (USD 212), a borrower can purchase a milking cow / buffalo, sewing machine, or set up an embroidery unit. Many of the women become leaders in their communities and undertake projects that benefit all the residents.

The repayment of loans plus interest generates funds that can be reinvested as a second and third loan or used to start other women on their journey toward sustainable prosperity. The entire community benefits from improvement projects taken on by these newly confident and capable leaders.

Microfinance institutions broadly operate under a wide range of legal structures. They could be registered as NGO, Trusts, Sec 25 Companies, Cooperative Societies, Cooperative Banks, Regional Rural Banks, Local Area Banks, Public and Private Sector banks, Business Correspondents and Non-Banking Finance Companies.

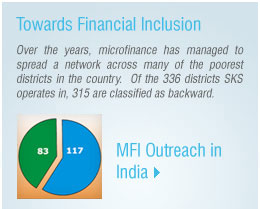

SKS Microfinance is registered with the RBI as a non-deposit taking NBFC-MFI and is regulated by the RBI.

Further Resources :

http://www.microfinancefocus.com

http://www.microfinancesouthasia.net

http://www.microfinancegateway.com