Infotech applications can add value in the unlikeliest places. Never be surprised by It's reach. Read on to see why.

BY K.JAYADEV

INFORMATION TECHNOLOGY DOESN'T ONLY SERVE

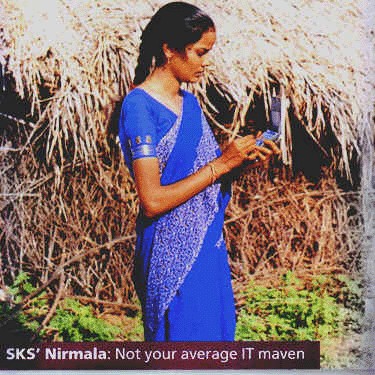

the hushed corridors of corporate high finance. To see It's potent leverage at work, you can also trek to the Telangana region of Andhra Pradesh, one of India's poorest areas, to meet Nirmala.

The college dropout is the manager of the Sadashivapet branch of an NGO in Medak district of Andhra Pradesh. These days, you can catch her travelling over 25 km from Sadashivapet to interior villages and conducting at least three meetings a day before 9 in the morning.

And when you run into Nirmala, you'll notice that her constant companion is trusty Palm that her constant companion is a trusty Palm Pilot, in one of those improbable juxtaposition that are, well, Indian.

The story of how this came about makes for a compelling story of how IT can be leveraged for the benefit of even the poorest of the poor.

Nirmala works of SKS (Swayam Krishi

Sangam) Microfinance, a Hyderabad-based NGO. SKS targets women and is based on

the popular Grameena Bank model of Bangladesh. It designed a microfinance

scheme for this region to enable poor families to cope with emergency needs and

generate income. It offers:

Group Fund Savings: Member are required to save Rs 5 a week and an additional five per cent of any income generating loan.

Voluntary savings: Members can put money aside in an individual savings account.

Income generating loans: Loans are provided so that people can generate income, build assets and become self reliant. Individual loans are contingent on punctual repayment by all group cards, which serve as electronic passbooks, to members of the scheme to replace manual passbooks. This was on top of a basic management information system (MIS) in place at every branch office.

The benefits have been profound. Today the SKS field staff not thorough banking professionals by any means are able to maintain and disburse amounts with greater ease. Rather than keying in all the data, managers like Nirmala can just plug in a handheld device and synchronise it with existing computer system in the branch office. She says, "We can devote out time to plan actions for training newer groups and try to rope in new members, which is what we are basically meant for."

The benefits for SKS are also immense:

It has lowered the cost of transactions

Enabled to poor and illiterate to use technology for their benefit

Given more time to the field staff to work on newer areas and schemes, as well as understand the problems of the poor better

Increased productivity of the staff

Reduced human error and fraud by having a single data entry point that seamlessly links information flow from the village to branch to the head office.

Enhanced speed and efficiency of MIS by allowing staffers to upload transaction information in seconds. This enables the management to have real time information, thus strengthening its ability to monitor operations and quickly respond to problems.

The smart card project of SKS is today a much talked-about initiative and is among the top competitors at the Stockholm e-governance challenge this year. Dinesh Choudhary, manager of SKS, enthusiastically says, "To see illiterate women, who only a few years ago came to SKS mired in absolute poverty, using high-tech tools for banking transactions demonstrates that given an opportunity, the poor can drastically expand the choices in their daily lives."

Having successfully used technology at one branch, SKS plans to take it to other branches and also make this system available to other microfinance institutions in the country. "In future SKS hopes to make smart cards a cash substitute that will enable us to offer a wide range of flexible financial services to meet the diverse financial needs of the poor, such as immediate loans for hospitalization or other emergency cash needs," says Choudhary.

But equally important, it has also freed Nirmala from processing, and allowed her to spend her time more usefully with the bank's account holders.

"More than collecting money and disbursing loans for villagers, today we can go to the people to find out how they are using the money given as part of the loan," she explains.

We'd call that leveraging technology to add value to staff functions. Whether you're on Wall Street or in Warangal.