|

|

|

|

|

|

|

Name:

Pahima

Age:

25 years old

Children:

Masan Jani, 7 years old;

Gau, 5 years old

Hometown:

Neredparla, Andhra Pradesh

SKS member since:

2004

Most recent loan:

Mid-term loan, $44

Business:

Bicycle shop owner; SKS

loan officer

SKS employee since:

2005, Neredparla Center,

Bhongir Branch

|

|

|

|

|

Pahima was just 21 years old when she divorced

her husband and moved with her two small children

back to her father's home. Over the next three

years Pahima struggled to support a family of

four.

In 2004, Pahima heard that SKS was opening

a branch in her village. With her first loan

of about $175, Pahima purchased five bicycles

and opened a cycle rental shop. Pahima charged

her neighbors about $0.07 per hour and $0.33

per day to rent her bicycles. A mid-term loan

of $44 allowed the purchase of three additional

bicycles. Before long, she was making about

$131 per month. The steady income from her bicycle

shop allowed Pahima to support her family for

the first time in almost four years.

Early in 2005, Pahima learned that her village's

SKS branch had a job opening. Pahima had completed

the tenth grade and was very interested in SKS's

work. She applied for the position and after

an intensive interview process, was selected

to become an SKS loan officer.

Pahima started working fulltime for SKS in

March of 2005. She now manages 20 loan groups

which consist of 605 clients and $64,200 in

loans outstanding.

"I am extremely thankful for the opportunities

SKS has provided me. I was unemployed and divorced

when I took my first loan and struggling to

support two children. With the income generated

from that first loan I was able to get back

on my feet and provide for my children. Now

as an employee of SKS, I am honored to help

other women, just as others helped me."

|

|

|

As

we prepare for rapid growth this coming

year, SKS is seeking experienced, energetic

and dedicated individuals for the following

positions. If you know someone that might

be a good fit please contact us at

[email protected]

|

| ›› VP

Finance |

| ›› VP

Technology |

| ›› VP

Operations |

|

|

|

|

|

|

|

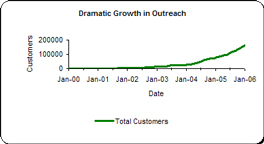

Over

the last few months, SKS has been quietly preparing

for what promises to be an extraordinary year

for the organization. Instead of resting on

our record breaking growth rate of 250% and

outreach of 170,000, we have decided to push

the envelope and attempt to scale even more

rapidly. By the end of the next fiscal year,

SKS plans to have over 700,000 clients, 360

branches and a portfolio outstanding of over

$117 Million. That correlates to a growth rate

of over 400% in all three categories!

In order to reach these lofty goals, we have

revaluated the way we think about operations

and further streamlined our systems and processes

to manage the capacity. We have already recruited

35 new area managers to lead expansion efforts

across the country, and will be adding approximately

125 new staff members each month. They will

be responsible for starting operations in some

of our existing areas as well as breaking new

ground in parts of India yet to be reached by

microfinance. But the plan doesn’t stop with

geographic expansion.

We are also looking to add a number of products

to our current offering to meet the total household

demand of the poor, currently estimated at around

Rs. 50,000 ($1,100), and reach additional client

segments we are currently not working with.

These include additional loan products, such

as housing, auto and education, new insurance

schemes for health, life and assets and unique

services like remittances.

We’re bound to have some growing pains along

the way, but strongly believe that in order

to have an impact on poverty in India we need

to reach as many poor families as possible.

We thank you for your continued support and

look forward to updating you as we strive for

“7 by 7.”

- Vikram Akula, Founder & CEO

|

|

|

| ››

Total Clients - 164,145 |

| ›› Total

Outstanding - $15,861,110 |

| ›› Total

Disbursed - $47,661,603 |

| ›› Portfolio

At Risk - 1.98% |

*As of January 31, 2006

|

|

›› International

Exposure Programme on Microfinance

& Micro Enterprises

Beijing, China.

Organized by College of

Agricultural Banking,

Pune. |

|

|

|

|